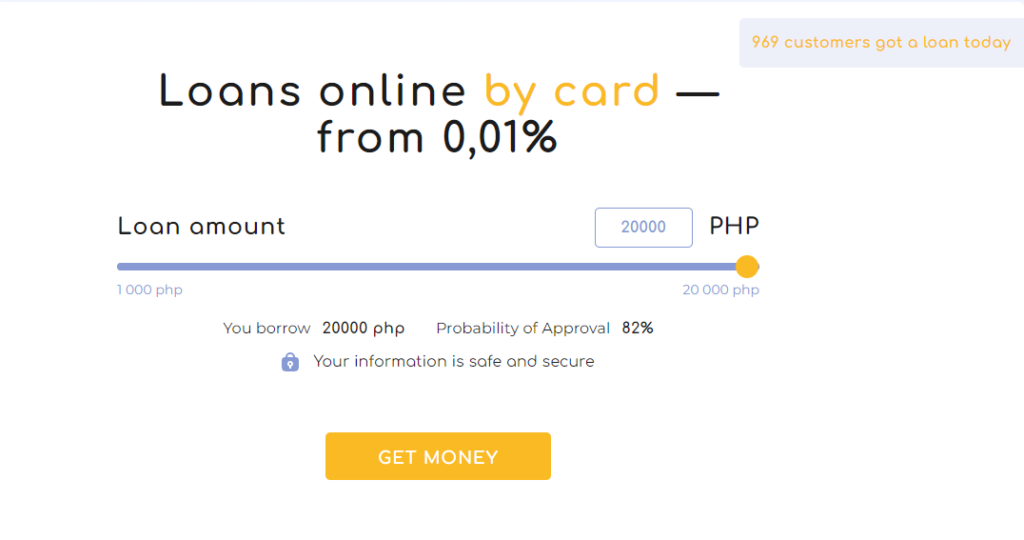

Only reliable loans online with a low interest rate – apply and get money in 10 minutes. Loans up to PHP 20,000 at 0% more with us. Take 20,000 PHP for 3 Months – Loans online by card. To Apply for a Microcredit, You Only Need a Passport and an IIN. Loans Online in the Philippines – at finonph.com.

3 Easy Steps to Get Loan Online

- Leave a request, we will reply in 10 minutes

- The system will process your information and offers you money collection options.

- In just 25 minutes you will be able to use the money

Receiving methods

- VISA/ Mastercard

- Cash

- Bank transaction

Example calculation and conditions

Minimum maturity: 92 days (3 months). Maximum maturity: 1,095 days (3 years). Annual interest rate (APR): from 3.5%. Early repayment is possible.

Examples of typical loan calculations: Example of calculating the cost of an online loan: Take 20,000 PHP for 3 months. The amount to be paid is 20,180 PHP. Fee: 180 PHP Interest rate: 3.65% per year.

The minimum loan repayment period is 92 days;

The maximum loan repayment period is 1065 days;

The maximum Annual Percentage Rate (APR), which includes interest and all other fees and expenses for the year, is 35%.

Credits: features of use

The service provides financial loans for any use: education, renting property, buying appliances, organizing a ‘hot’ tour, covering the costs of medical treatment or repairing appliances (cars). In addition, a microcredit can help you get money quickly if your clients are behind in their payments.

You can get a loan even if you have a bad credit history. An online microloan can help you in this case. The customer can use the money as they wish. The main thing is to pay back the loan on time.

Which are the terms of microcredit, the maximum amount and term of repayment?

For customers using the service first time, the maximum amount is max 1,000 php. Upon reapplication and provided that the customer has repaid the previous loan on time, the microloan amount increases to 20,000 php. The maximum loan term – 1,065 days. Minimum – 93 days

Who can apply for a microcredit?

We offer credit to customers aged from 18 to 65 years. The service is provided for: young mothers on maternity leave, students, freelancers and self-employed, pensioners. Absence of official work registration and the presence of unsecured credit also do not act as an obstacle to get the credit. The microcredit terms are the same for all customers, irrespective of age and type of income.

Is it necessary to visit the office for a microcredit?

Not necessarily. Real-time loan processing is available. The company operates seven days a week. We guarantee fast processing of applications.

How to issue a credit?

To request a microcredit, you must fill out a form. Required fields: details of the working place, full name, current contact details. After processing, the system automatically sends the application to 10 microfinance organizations, the trend is increasing the probability of a positive credit decision up to 100%.

An important point: the accuracy of the information. If you initially provide the wrong place of work or incorrect salary information, the microcredit application may be rejected. Before submitting the form, you should carefully check that all fields are filled in correctly.

What is the interest accrued?

The interest rate varies depending on the characteristics of the financial service. In average, 0.01% per day is charged on the credit amount. If the customer fails to return the money on time, the interest rate will increase. To apply for a microcredit, you only need a passport and an IIN

How do I get money on loan?

After approval of the application, the credit funds are transferred to the specified card number. The customer specifies the bank card number when filling in the form. The money is credited to the account within 15-30 minutes after receiving a positive decision.

How to increase the chances of approval?

To increase the chances of a positive lending decision, it is important to improve your credit history. There are some ways: Pay with a credit card in stores, replenish your account regularly, do not delay open payments loan. In most cases, if the information is correct and after a successful review, the customer will receive a positive credit decision.

Is there a surcharge for application review?

In most organizations, application processing is offered free of charge. However, there are a number of microfinance organizations that receive a token commission for organizational services.

How can I return my loan?

There are several methods available. The quickest and simplest way is to repay the loan through your personal account. A special form on the website indicates the amount that will be automatically transferred from the customer’s account to the MFO account. To pay you can use the use plastic, to which the loan money was transferred, or another option.

An alternative option is to use payment terminals or special services. In this case, you will have to pay a commission for the transfer of funds (the amount depends on the conditions of a particular service). You can also use mobile payment systems or electronic wallets.

Is there liability for overdue loans?

If the customer violates the obligations to repay the loan, he will be fined. The presence of an SMS warning (alternatively: an e-mail) will help you navigate the upcoming payment date. Expert advice: deposit money on the day you receive the notification The timely repayment of the loan is reflected positively in the credit history, which helps to increase the amount of loans in the future. In case of impossibility to make a payment on time, it is necessary to contact the representative of the MFI. Lenders meet the needs of clients by postponing the loan repayment period (the minimum period is 3 days). Otherwise, a fine is imposed, and the debtor’s data is blacklisted and disclosed to collectors.

Contacts

- Address: Philippines 124 of, 768 Juan Luna St, 282 Z 28 Binondo, Manila, 1006 Metro Manila

- Phone: +63 225 681 423